by Nick Irmo | Apr 17, 2023 | Preparing to Purchase a Home

VA Home Loan and Relocation Guide for Fort Bragg Fort Bragg VA Home Loan and Relocation Guide: Your Comprehensive Resource for a Smooth Home Buying Experience As a military veteran stationed at Fort Bragg, you deserve the best support when it comes to purchasing a...

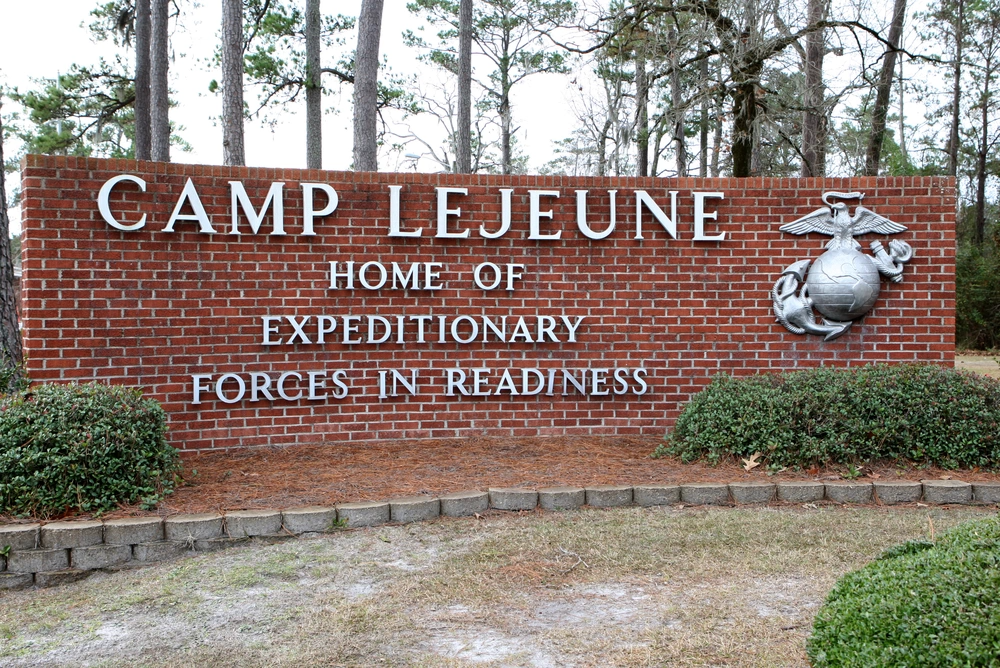

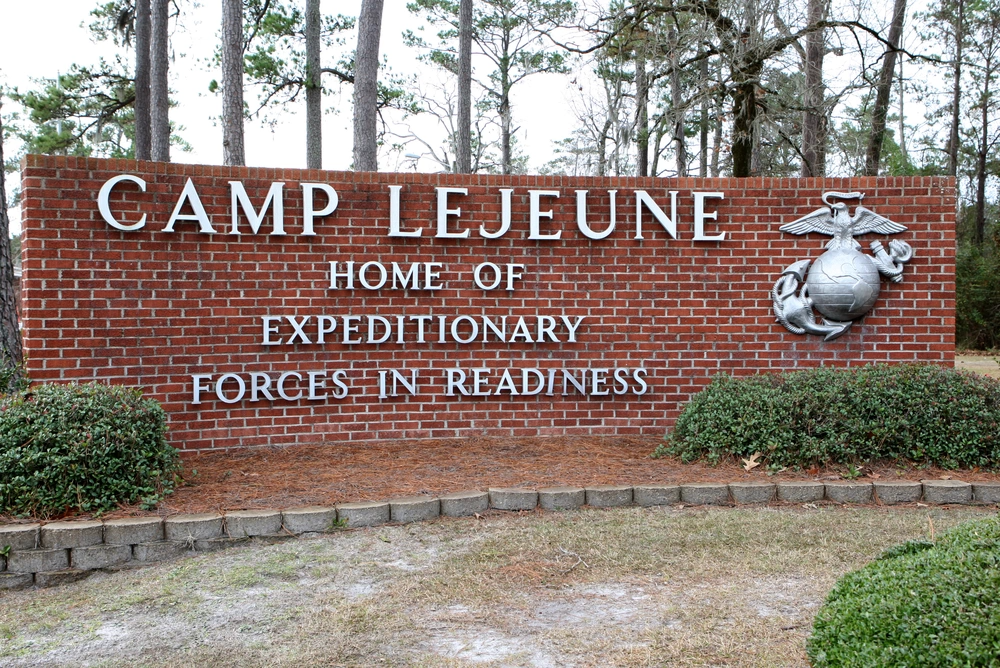

by Nick Irmo | Apr 9, 2023 | Preparing to Purchase a Home

VA Home Loan and Relocation Guide for Camp Lejeune VA Relocation and VA Benefits Our guide covers topics such as PCSing, VA loan benefits, preparing for homeownership, finding a real estate agent, choosing the right lender, and debunking VA loan myths. We also provide...

by Nick Irmo | Mar 31, 2023 | Preparing to Purchase a Home

$15K Down Payment Assistance for NC First-Time Buyers First Time Homebuyer Programs Buying your first home can be a daunting task, but with the right tools and resources, it can be a dream come true. One of the most significant obstacles for first-time homebuyers is...

by Nick Irmo | Oct 20, 2022 | FAQs

Glossary 3/1, 5/1, 7/1 and 10/1 ARMs Adjustable rate mortgages in which rate is fixed for three year, five year, seven year and 10-year periods, respectively, but may adjust annually after that. Adjustment Date The date that the interest rate changes on an adjustable...

by Sarah Pasik | Oct 20, 2022 | Loan Program Resources

What Are My Mortgage Options? Common Loan Products You may have heard of these common loan programs: Conventional, VA, FHA, USDA, ARM (Adjustable Rate Mortgage), and Jumbo…but what do they mean? Conventional The conventional mortgage is the most commonly used loan...

by Sarah Pasik | Oct 20, 2022 | The Mortgage Process

Understanding Home Appraisals What is a Home Appraisal? An appraisal is the estimated value of a property determined by a qualified appraiser. An appraiser will give an opinion of the property’s fair market value based on their knowledge, experience, and the...

by Sarah Pasik | Oct 20, 2022 | The Mortgage Process

How To Choose The Right Loan Officer For You Character Traits According to the Bureau of Labor Statistics, they are normally responsible for contacting companies inquiring about loan needs, meeting with loan applicants to gather personal information, obtaining and...

by Sarah Pasik | Oct 20, 2022 | The Mortgage Process

Top 10 Dos and Don’ts During the Loan Process What Not To Do: Z Don't Apply for New Credit of Any Kind If you receive invitations to apply for new lines of credit, don’t respond. If you do, that company will pull your credit report and this will have an adverse effect...

by Sarah Pasik | Oct 20, 2022 | Preparing to Purchase a Home

Understanding The Mortgage Process Step 1: Start Early The first thing that you need to do when you have decided to purchase a home is determining the negotiables and non-negotiables involving where you will reside and start your research. What do you want in the...

by Sarah Pasik | Oct 20, 2022 | Loan Program Resources

Second Home Loans Unlike investment property loans, which are strictly for homes purchased with the objective of generating income, vacation home mortgages allow the borrower to purchase a home that will be used for personal enjoyment. Even if you wish to rent out the...