by Nick Irmo | Apr 17, 2023 | Preparing to Purchase a Home

VA Home Loan and Relocation Guide for Fort Bragg Fort Bragg VA Home Loan and Relocation Guide: Your Comprehensive Resource for a Smooth Home Buying Experience As a military veteran stationed at Fort Bragg, you deserve the best support when it comes to purchasing a...

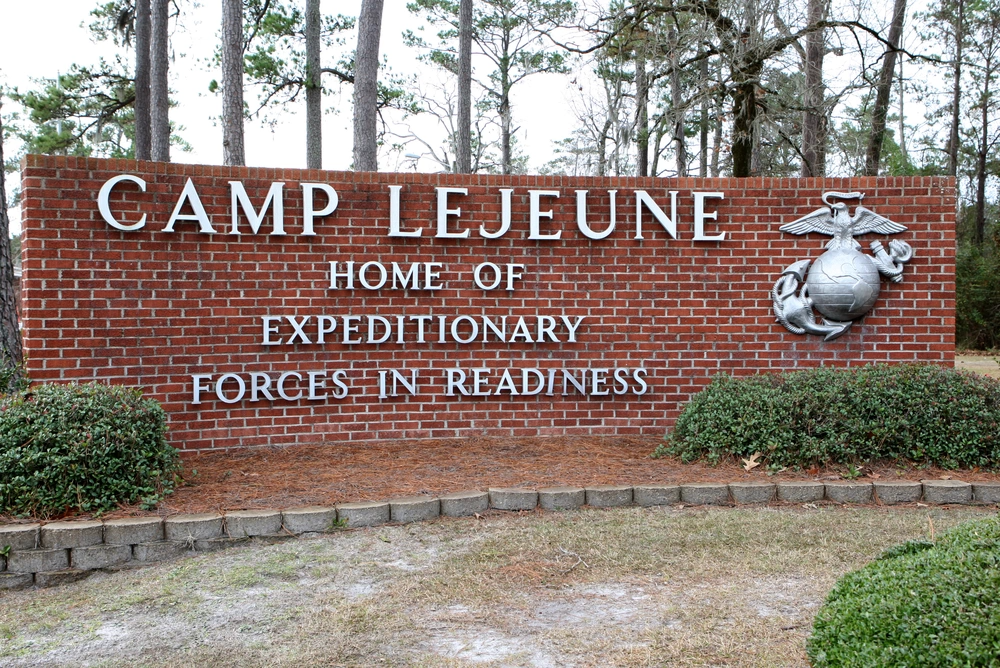

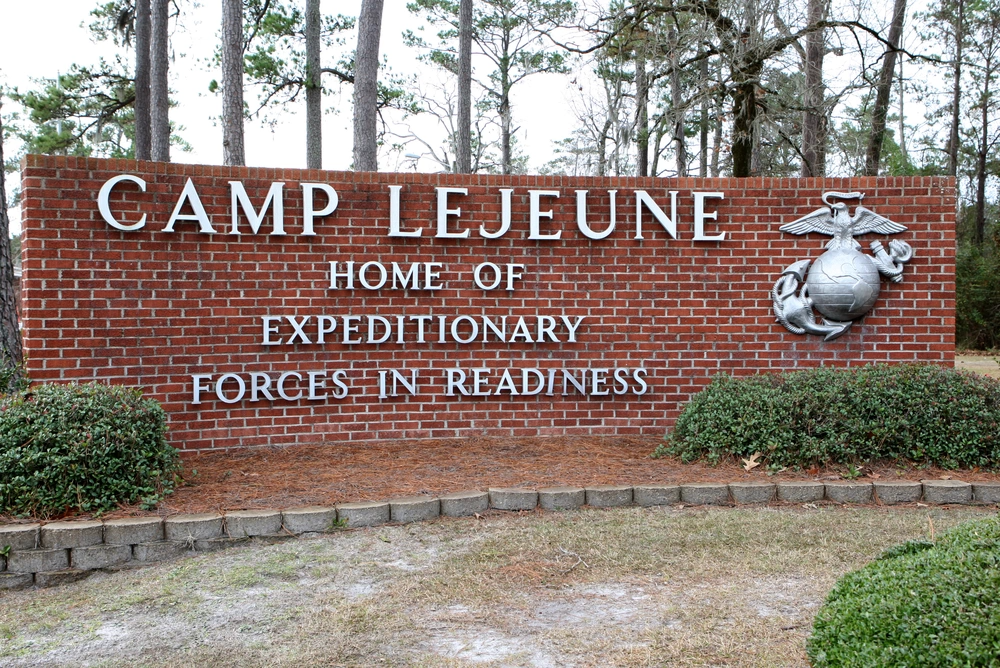

by Nick Irmo | Apr 9, 2023 | Preparing to Purchase a Home

VA Home Loan and Relocation Guide for Camp Lejeune VA Relocation and VA Benefits Our guide covers topics such as PCSing, VA loan benefits, preparing for homeownership, finding a real estate agent, choosing the right lender, and debunking VA loan myths. We also provide...

by Nick Irmo | Mar 31, 2023 | Preparing to Purchase a Home

$15K Down Payment Assistance for NC First-Time Buyers First Time Homebuyer Programs Buying your first home can be a daunting task, but with the right tools and resources, it can be a dream come true. One of the most significant obstacles for first-time homebuyers is...

by Sarah Pasik | Oct 20, 2022 | Preparing to Purchase a Home

Understanding The Mortgage Process Step 1: Start Early The first thing that you need to do when you have decided to purchase a home is determining the negotiables and non-negotiables involving where you will reside and start your research. What do you want in the...

by Sarah Pasik | Oct 18, 2022 | Preparing to Purchase a Home

Can I Afford a House? Considerations The question, ‘Can I afford this home?’ seems for the most part straightforward. You either can or you can’t. But what goes into determining the answer is where the complexity sets in. Below we have compiled a list of 5 important...

by Nick Irmo | Oct 17, 2022 | Preparing to Purchase a Home

How Credit Scores Affect Qualifying for a Home Loan What is credit? The credit scoring system was originally designed in the 1950s to help lenders determine how well consumers could pay back borrowed money. While there have been many updates to how this system is...